After a year of record-breaking investments, which saw massive amounts of money flowing into the financial system, the start-up ecosystem is now staring at a dry spell.

In the last two years, a massive influx of capital has reached different financial sectors due to excessive money coming into global markets. This capital, as a part of large investment funds and big capital allocations, was exported to every country, mostly addressed to the emerging markets, in the investors’ attempt, during the phase of high liquidity, to diversify their capital pool. An example of this came from India, the third largest start-up ecosystem in the world, which saw the massive deployment of funds into its technology sector. According to Business Today “When a flood of capital chases start-ups, the risk lens often gets impaired, views become biased, and growth, not profitability, drives investment decisions”. The increased fear of missing out, on potentially market-disruptive investments, also strongly accelerated the speed at which funds were investing their money. This led to deals being closed in less than a week with very little dive into companies’ structure and feasibility.

A closer look at the numbers

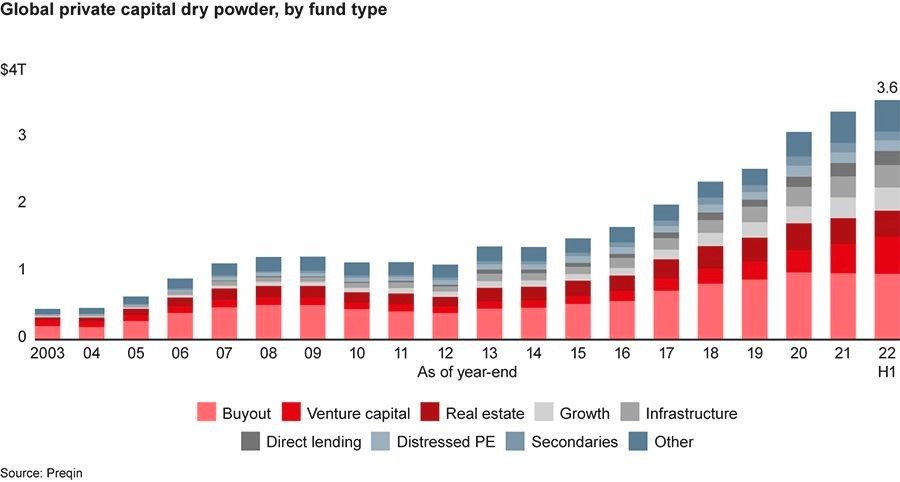

Despite the numerous uncertainties hovering around the economic system, a strong amount of large funds managed to positively close the first half of 2022. Global fundraising however soon started to show a sharp decline, especially among buyout funds. Globally, according to a study from Preqin, $645 billion of private capital was raised this year, compared to last year’s record high of $789 billion in the first half of 2021. Similarly, buyout fundraising fell from $284 billion to $138 billion.

In the US the deal count was still very high, as well as the number of investors entering the market, despite the economic downturn. According to the Financial Times, almost 3,600 different funds raised money in the past four years, now waiting on $645 billion of dry powder.

These record-high levels of dry powder have been impacting the global private equity market, causing both a reduction in deal volumes and fundraising levels compared to 2021, according to a new report from Bain & Company. In the first half of 2022, private equity firms generated about $512 billion in acquisition deal value, which, despite being less than the one in the first half of 2021 was still encouraging high.

In line with this result, shown by the report from Bain & Company, also the number of deals closed in the first half of the year has been positive, breaching the 2,000 mark. This trend, however, is doomed to cease in the second half of the year, as the increasing impact of geopolitical and economic uncertainty and the cyclical nature of private equity is paving the way for a decline in the deal pipeline in many sectors. The technology one is set to be hit particularly hard after the record amounts of deals achieved and money poured into the start-ups’ ecosystem in 2021.

The three key factors behind the fall

The explanation behind the drop in funding in both VC and PE can be connected to the complexity of the economic system. The different macroeconomic factors impacting the economy in recent times have led to a substantial constraint in the flow of money transiting into Venture funds. Three main issues may be considered as the drivers that accelerated the slum in funding, hitting the economy at its very core and creating a first deviation from the trend characterized by low-interest rates, low inflation, and low growth that has defined the European system for a long time: Global inflation, The invasion of Ukraine, and the Covid-19 pandemic.

Global Inflation:

One of the main explanations for VC fund scarcity is global inflation. Specifically, its connotation with regard to the necessary monetary policies put in place by central banks to battle the ascending economic prices. Central banks have significantly raised their interest rates, on a global scale, to both contrast the monetary crisis and shrink the historically-high liquidity poured into the economic system after the pandemic. The newly adopted policies have forced investors to shift their investment portfolio from high-risk assets like VC investments to relatively lower-risk fixed-income-yielding products. Concerns about companies’ profitability mixed with the high-interest rates, led to a slowdown in VCs’ deal activities, with firms storing capital on the sidelines.The accumulation of such dry capital mostly hit those businesses dependent on equity funding, for which this slowdown strongly impacted the pace of funding rounds and growth.

The war in Ukraine:

The conflict between Russia and Ukraine has significantly impacted the global VC and PE funding mechanism. The increased feeling of uncertainty about the length and the after-effects of the conflict, as well as unfavorable market sentiments, and global macroeconomic risks accompanied by the war in Ukraine, have had a big impact on the global economy. High-risk equity projects and VC investment prospects were put on indefinite hold, in favor of more stable and fixed-income activities. A 2022 Crunchbase report stated that global VC funding witnessed a drastic slowdown following the Ukraine invasion, reducing from an average weekday seed funding of $1.9 billion for startups to one of $912 million.

The Global Pandemic:

Despite the initial massive boom for the startup ecosystem fostered by the pandemic, the negative effects of Covid-19 have been incommensurable on the economic system. The numerous waves have left dregs on the global economy and are still present and visible. In 2020, during the initial few months, when the pandemic shook the world’s socioeconomic structure, VC investments shrunk by almost 30%.

What has changed?

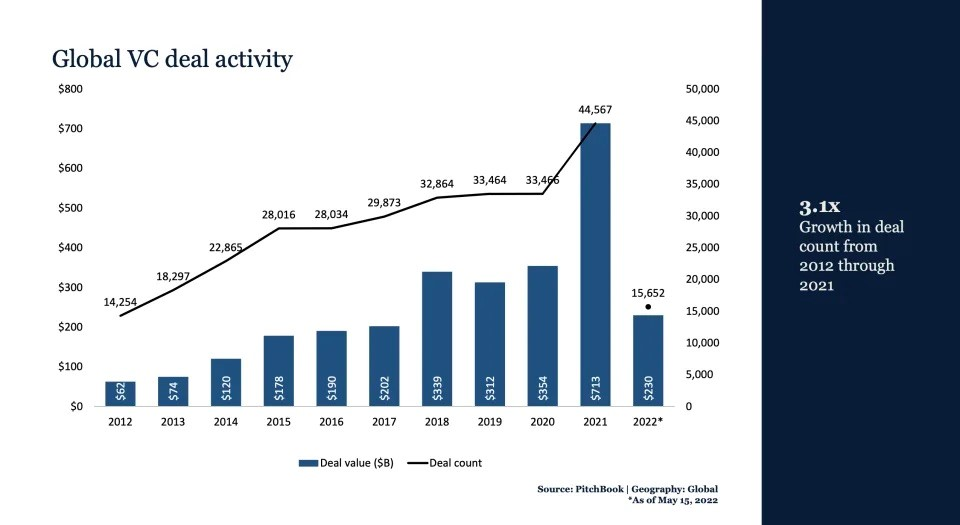

Despite the above-mentioned factors, globally, VCs have kept raising funds at a sustained rate thanks to record levels of capital flowing in from non-traditional sources. These types of investments — mostly driven by private equity firms, hedge funds, and mutual funds — have in recent times accounted for almost 40% of the global deal count composition.

Along with non-traditional sources, non-traditional types of companies have also attracted most of the capital deployed. Recent Pitchbook data show that VCs have started investing mainly in companies that are seven or more years away from an IPO, to avoid the comparison with already publicly listed competitors and to prevent a decline in valuations.

With capital being poured at such high speed into the economic system, investors stopped sifting through the quality of companies. Talents everywhere were drawn by the opportunities offered by the market and started taking risks, crossing over from traditional companies to found start-ups.

A surprisingly high number of start-ups, therefore, emerged, adding to the exponential pandemic-induced digital acceleration of businesses, all leading to the oversubscription of funding rounds and to start-ups raising capital at all-time high valuations.

This came at a cost. All of a sudden the tap started drying up. Unheard of as a considered metric, profits began to be looked at closely. Questions were raised regarding both the quality of the start-ups being funded as well as the quality of due diligence being followed by VC firms. The lack of auditing paralyzed the investment cycle, forcing a prompt switch in paradigm toward companies that prioritized efficient growth over growth at all costs.

What does the future hold?

With the capital markets drying up, more emphasis has been put on companies that are disciplined about spending, show solid basis, and have control over their future. The combined result of all these factors has been the delay in capital deployment and the prolonged slowdown in investments.

According to Varun Gupta, Director for D&T Investment Banking at Avendus Capital, this economic slowdown will most likely affect the financial space only for one or two quarters as many companies have already raised capital. More clarity in terms of how both the overall external environment and public market are going to behave is expected and will bring future opportunities for the global economic system. According to this vision, investors will soon start operating very actively to deploy this record mountain of dry powder worth $3.6 trillion, currently stagnant on the market, waiting to be invested.

While this can be seen as an untapped opportunity from the perspective of fund investors, the dry powder also offers many opportunities for private equity funds, as historically deals made after a recession has yielded strong returns. Even though it’s not possible to predict an ideal situation when it comes to financial cycles and venture capital, it’s commonly agreed that excesses of capital in the system bring some good as more start-ups get funded and thus more innovation is fostered. But a shortage of capital, on the other hand, can also be considered positive as it enforces more discipline. Therefore, going through both cycles can create a desirable balance, as long as it can be contextualized with the overall economic trends.