Special edition! In collaboration with The Dutch Venture Capital Journal, a weekly report including the latest fund(ing)s in the Dutch tech venture scene, we present you all disclosed fund(ing)s from the past second quarter. Including first and foremost, a clear record-breaking €2.48 billion investment sum for Dutch ventures.

???? raised by ????????ventures

A whopping 2.48 billion euros have been invested in 68 Netherlands-based startups and scaleups in the second quarter of 2021. In comparison: €0.25 billion was raised by Dutch ventures in 2020’s Q2 and €0.22 billion venture capital was invested in 2019’s second quarter. So compared to 2020’s Q2, the Dutch venture scene has increased its investments income by tenfold! In fact, 2021’s second quarter has been a massive record-breaking quarter that outclasses all previous quarters in Dutch startup and scaleup history.

The leaders of the pack

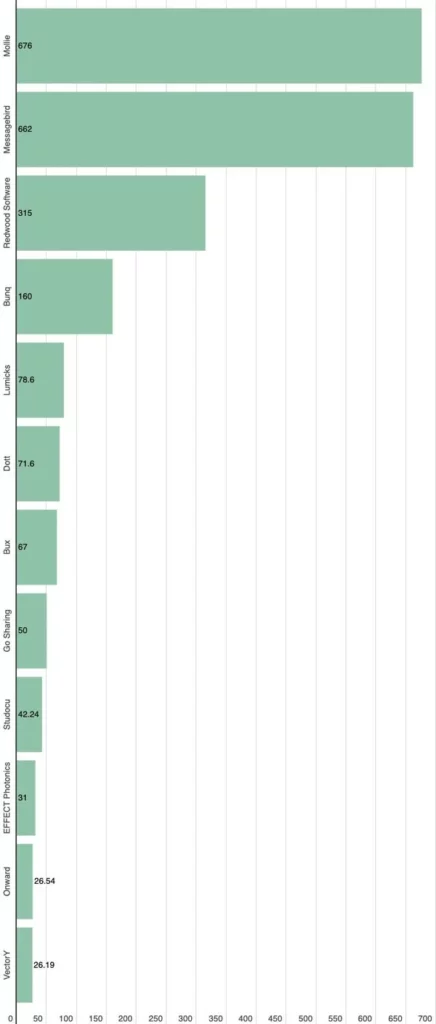

Which Dutch ventures left their marks? Let’s take a closer look at the 12 Dutch tech ventures that were able to raise more than €25 million during their investment rounds in Q2. Mollie, Messagebird, Redwood Software, bunq, Lumicks, Dott, Bux, Go Sharing, Studocu, EFFECT Photonics, Onward and VectorY.

Beyond €25 million investments in Dutch ventures in Q2:

Investment amounts in millions of euros, per company

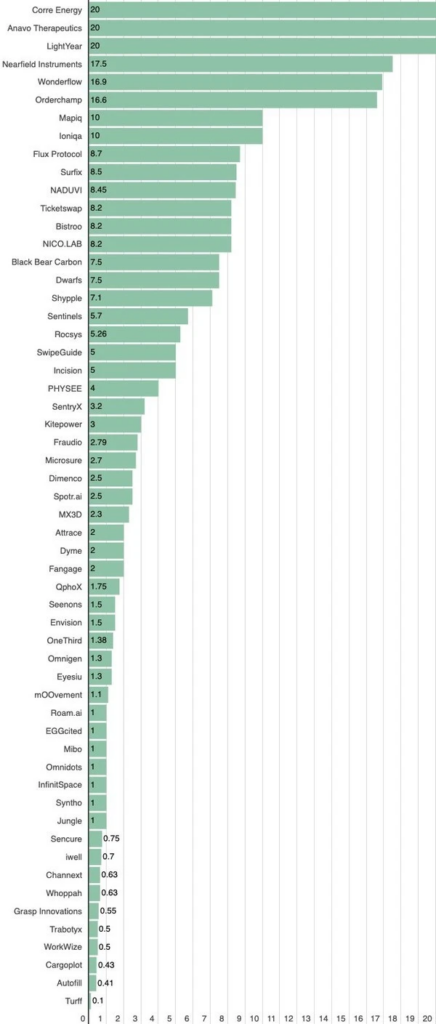

The other ventures that succeeded to close funding rounds in Q2, are similar to the top 12 considered as front-runners in fintech, biotech, health tech and cloud computing. Additionally, they are accompanied by ventures in the fields of green tech, high-tech, internet-of-things and agritech.

Beyond €25 min investments in Dutch ventures in Q2:

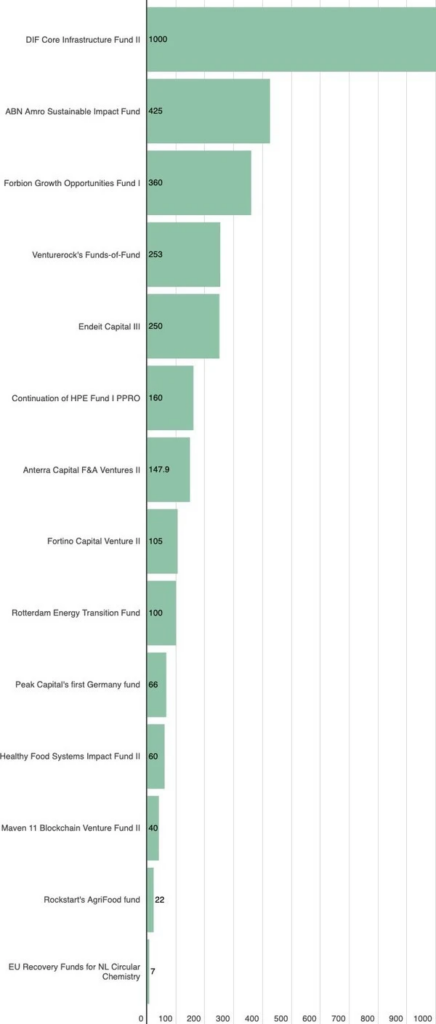

New funds from ???????? investment firms in Q2:

Whereas the Dutch ventures scene raised a whopping €2.49 billion, the Netherlands-based venture capitalist market still surpasses that number: together they have reserved €3 billion (2.996) for funds that invest in new waves of promising startups and successful scale-ups.

We end this special report with our own selection of beautiful Q2 startup stories. Riverside.FM is such a story, about two brothers that have shown the resilience and determination to successfully build a startup as digital nomads in Israel. Of course, the investment of Google’s Black Founders Fund in Michael Musandu’s Lalaland marks another milestone for our venture scene. We can keep on talking, for example about the importance of Catawiki‘s profitability, but recommend just start reading yourself ????.

???????? The nicest achievements stories of Q2

A Jewish, Dutch boy moves to Israel by himself, joins the navy, gets seasick, and develops the podcasts platform Riverside.FM. He starts a company with his brother, competes with Zoom and Google, and catches Hilary Clinton’s eye.

Amsterdam-based fashion-tech startup Lalaland.ai grabs coveted spot in Google fund for black founders — siliconcanals.com

Lalaland.ai, the Amsterdam-based fashion-tech startup co-founded by Michael Musandu, is selected for the Google Black Founders Fund.

Bounty island Fuvahmulah chooses to upgrade their existing vacuum sewer system to Vacuflow® — quavac.com

On the bounty island Fuvahmulah, Qua vac has upgraded their existing vacuum sewer system to Vacuflow®.

My startup tripled in size in 2020: Here’s what I learned

Moving quickly is a non-negotiable in the startup world, but that doesn’t mean you can’t also move purposefully.

Amsterdam home of Europe’s 1st music tech accelerator

siliconcanals.com WeWork has joined hands with boutique innovation consultancy firm BW Ventures to launch the 1st music tech accelerator programme in Europe, based in Amsterdam.

$100M for JW Player to roll-out subscriptions model

JW Player, founded by Jeroen Wijering and Dave Otten, is a very early mover in the market for online video technology — it powered YouTube’s first video player, before Google acquired it and it built its own — has long been profitable through a business model of providing one-to-many video streaming tools to publishers.

More:

- Catawiki continues its growth and reports first profits

- Flying Start: Keiron obtaining revenues and subsidies

- Talent Inc. buys Resume.io from Breda’s Imkey Holding

- WeTransfer Is Said to Plan IPO at 1 Billion-Euro Valuation

- How Teamleader leveraged new pricing and packaging for a 22% increase in ARPA in less than a year Capital