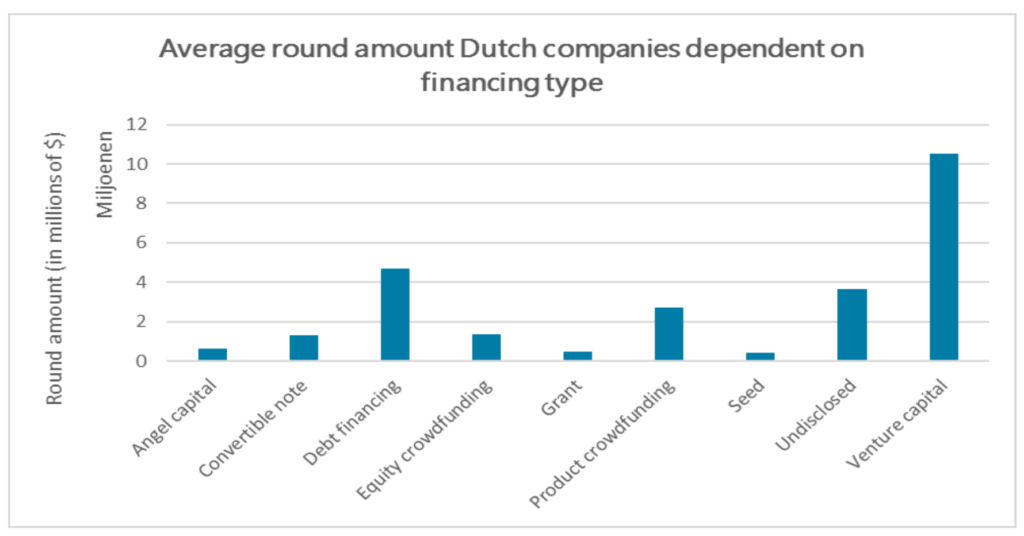

To grow rapidly and hire dozens or even hundreds of employees in a short time, startups and scaleups need external capital. What financing options are available for ventures? We’re starting a series on external capital to explore this. Throughout the series, we’ll guide you through six landscapes, each with its own financing solutions. First, we’ll visit the ‘The Hague of external capital’, i.e., the world of grants. Then, we’ll take a detour to the ‘Hilversum of growth capital’, with its innovation awards and other monetary prizes. We’ll also metaphorically visit the ‘Zuidas of cash injections’, encompassing various loans. Next, we’ll fly to the ‘Silicon Valley of finance’, full of angels and venture capitalists. We’ll also cover the ‘Las Vegas of growth money’, featuring Initial Coin Offerings (ICOs) and ‘distributed ledger-based’ payments. Finally, we’ll pop the champagne while discussing various types of stock market listings. To understand these types of financing, we’ll dive deep into each one. This is especially true for investments, a frequent occurrence at EBITWISE, like the €3 million investment round for The Next Closet we supported in 2021. Figures show that Dutch ventures rely heavily on investors. For instance, Rosalynn de Jong graduated cum laude from Tilburg University a few years ago, researching financing forms grabbed by Amsterdam startups. Her 2018 results, partially shown below, highlight that ‘Venture Capital’ earnings stand out significantly. This category also includes ‘Private Equity’, not listed here due to its much higher average earnings compared to other funding sources.

For now, we’ll briefly describe the types of financing that will be featured on our site:

Grants

Government and semi-government organizations award grants, typically for funding specific business activities. They often come in the form of matching grants, where you as an entrepreneur must meet certain requirements. For example, the WBSO, a well-known grant in the Netherlands, is only for companies that demonstrably develop innovative services or products.

Awards and Gifts

Awards and gifts are usually from foundations and larger companies. Award givers often aim to honor a venture’s innovation. A Dutch standout in winning awards is the neighbor-lending platform Peerby, which has won various sustainability contests in the past, including Join Our Core, Clinton Global Initiative, App My City Award, and the Postcode Lottery Green Challenge.

Loans

Primarily the domain of banks, but there are also online platforms that enable companies and citizens to lend money. Companies might offer something in return, like pledging inventory as collateral, or receive loans based on established creditworthiness.

Investments

As demonstrated, this is the largest funding source for ventures, where founders give up a portion of their ownership to an external financier. The way founders relinquish shares can take many different forms, which we’ll cover in detail in a separate blog.

ICOs, Blockchain, and Distributed Ledger-Based Financing

An exotic, increasingly popular variant among capital providers. How has the cryptocurrency landscape proven fertile for a growing number of startups and scaleups? And will it remain a staple among financing forms? We’ll dedicate a blog to this topic as well.

Going Public

Not only does the traditional path to exchanges like AEX or NYSE mark the end of a company’s scaleup phase. We’ll also introduce you to the world of SME exchanges and SPACs.

Starting mid-February, our first stop will be the land of grants. Hop on!