A golden age of increasing investments in Dutch ventures has ended. Our startups and scaleups have raised approximately €1.27 billion in venture capital in the past quarter. That is just about half the capital that Dutch ventures collected in Q2 2021, when the scene raised a record-breaking equity-capital of €2.48 billion.

This is the outcome of EBITWISE’s Dutch Venture Capital Quarterly, a quarterly analysis of all published investment rounds by startups and scaleups from the Netherlands. Our open-sourced results show that indeed, as the world-famous startup accelerator Y-Combinator yet identified in May, the funding prospects for ventures are fading due to major global economic setbacks related to the war in Ukraine.

Especially the number of Series A to F deals has decreased. Our previously open-sourced Q1 2022 report includes ten investment rounds that exist of venture capital from €25 million up to €50 million. For Q2, there is none of this kind of deal size.

Thanks to a major €420 mln investment round by Perpetual Next our Dutch venture scene still surpassed the €1 billion mark the past quarter. Other substantial investments were raised by Backbase, Pyramid Analytics, In3, Smart Photonics and TestGorilla.

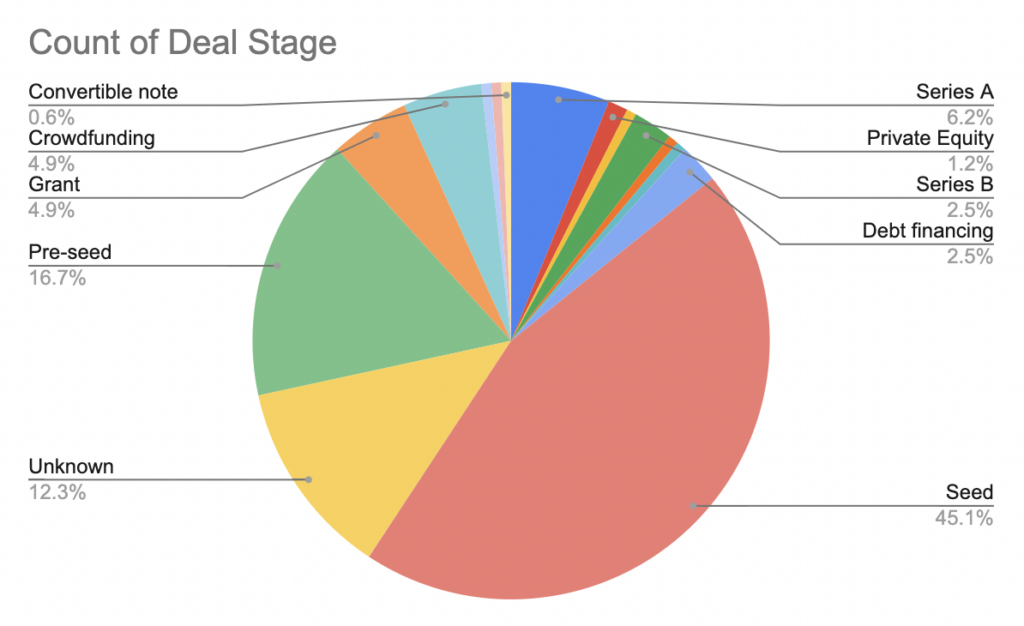

Looking more closely at all rounds, there is a sort of consensus about the capabilities of the Dutch venture capital scene which has been confirmed this past quarter: ventures from the Netherlands are mostly able to raise seed funding. In Q2, seed and pre-seed deals together represent 61.8% of rounds closed in the past quarter.

Although economic insecurities have tempered the investing willingness of venture capitalists, some markets continue to attract a relative higher number of investors. Sustainability, fin-tech and medtech solutions have been top-ranked markets for the last quarters and years as well.

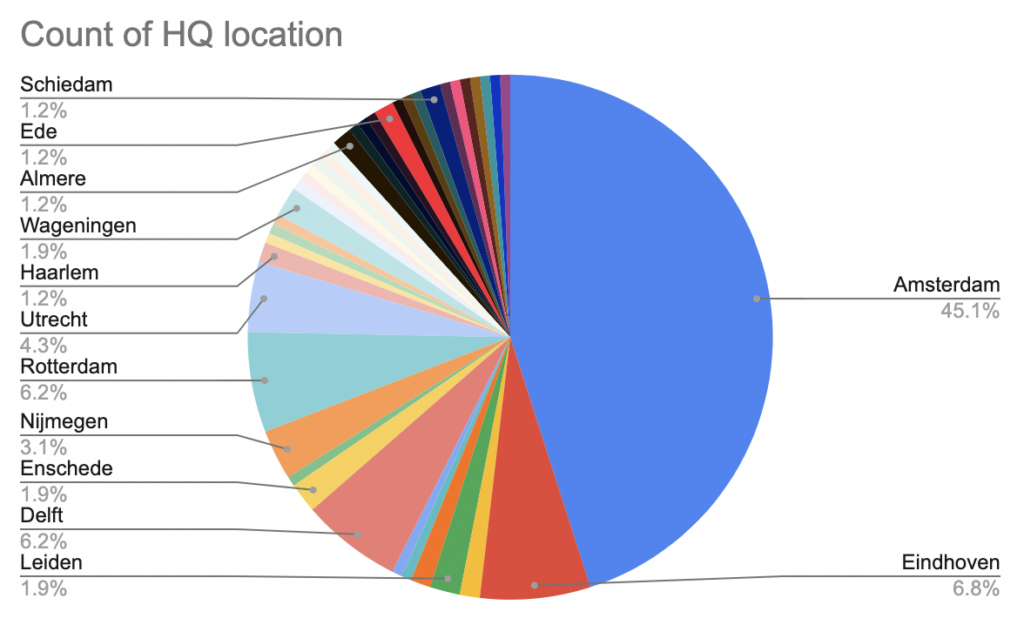

Also, a familiar picture is the top position of Amsterdam as the most popular HQ location amongst venture capital-backed startups in the Netherlands. With almost half (45.1%) of all past quarter-funded ventures having their head office in the capital of The Netherlands, the contrast with the numbers two (Eindhoven, 6.8%) and three (Rotterdam, 6.2%) is substantial. Compared to previous quarters in the past years, there are fewer records from investment rounds for ventures from Enschede, Groningen and Wageningen.

On a side-note: compared to our Q1 report, we have now completely aligned to what traditionally is considered venture capital in the Netherlands according to business news outlets. For example, in the previous report, we included one significant SPAC-merger in our quarterly, though prominent investors argue they should be considered venture capital. Read for example the expert blog SPACs are venture capital in public markets.

And by doing this, we can end this blog with one positive conclusion: compared to Q1, our Dutch ventures have actually raised more capital in Q2: €1.27 billion versus €1.03 billion.

Any questions or remarks? Send an email to sebastiaan@ebitwise.nl